Automated Two Factor Authentication

Attacks by hackers and fraudsters are responsible for billions of dollars worldwide in fraudulent financial transactions each year. These Internet pirates are getting faster and smarter and are able to get around many of the costly security measures which are meant to protect against them. It’s time to step up security. Spriv’s automated two factor authentication foils even the most sophisticated attacks. How? Spriv will automatically authenticate the user if the user is near authorized computer and, equally important, Spriv will inform your security platform if the user left his authorized computer. No other Adaptive two factor authentication platform does that.

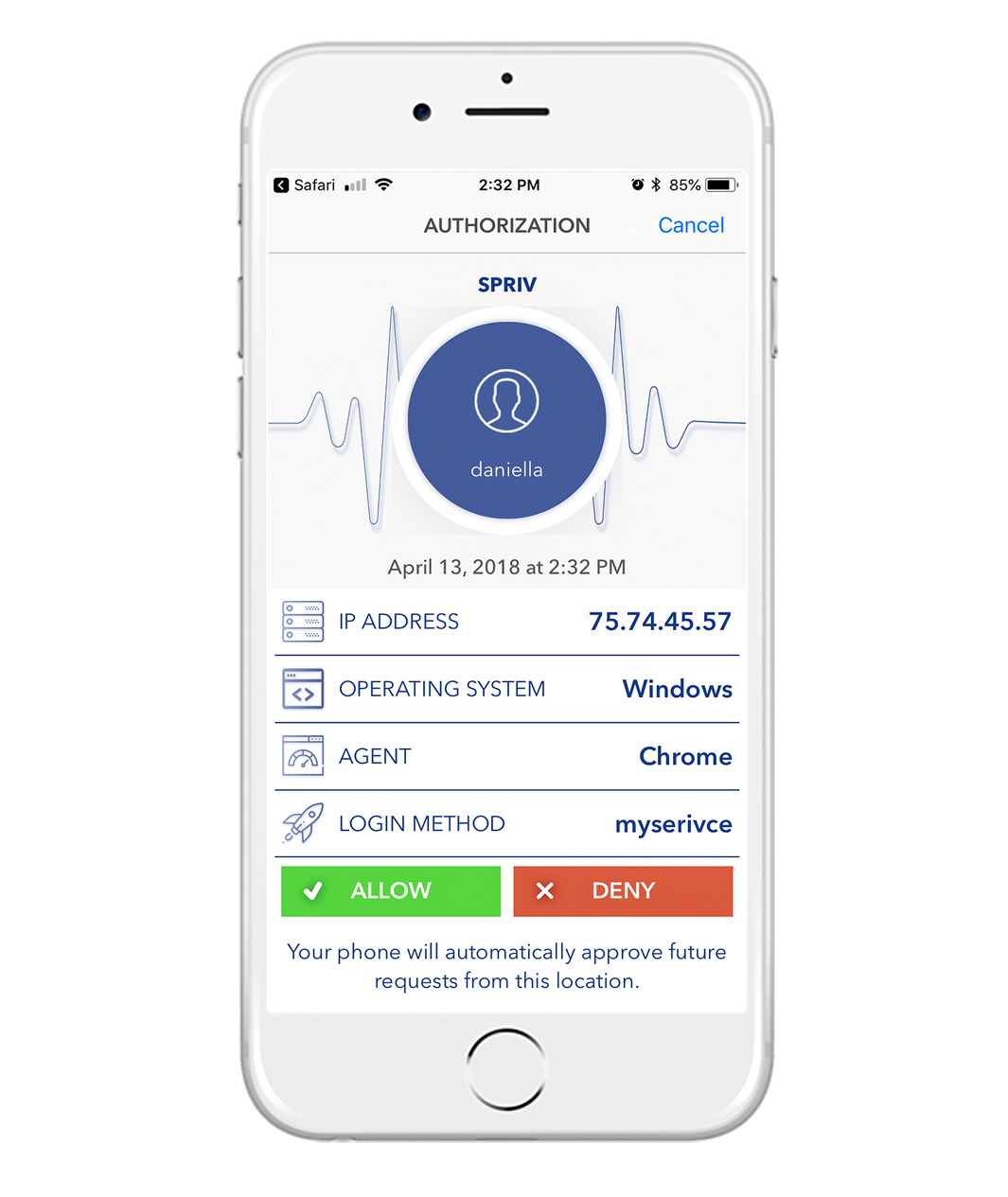

Malicious code running on the user’s computer can hijack a user’s authenticated session without detection by the online banking application or the end user. Fraudulent transfers to mule accounts are initiated once the session is jeopardized. The only way to protect against these attacks is to authenticate the transaction through a secondary, or out-of-band, channel. Spriv does this automatically with no user intervention.

It’s easy to add Spriv’s seamless two factor authentications. Since Spriv’s automated 2FA cloud is designed to integrate with any device that has internet connection. Because Spriv can authenticate two factor automatically in the background without the need for user intervention, the option now exists to allow seamless two factor authentication for every login not only the high-risk transactions, but also for medium- and low-risk transactions. In addition, Spriv’s automated two factor authentication platform can be used to authenticate any high-risk transaction or event, such as remote login, password resets, money transfers, account changes and more.